|

- Financial trust increased from 22 percent in 2008 to 28 percent at the end of 2018, according to a survey marking the 10-year anniversary of the financial crisis.

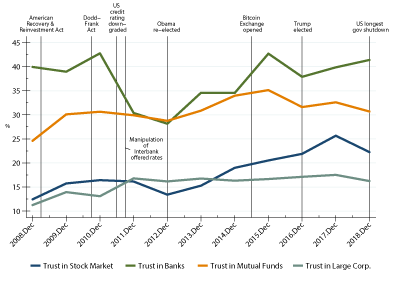

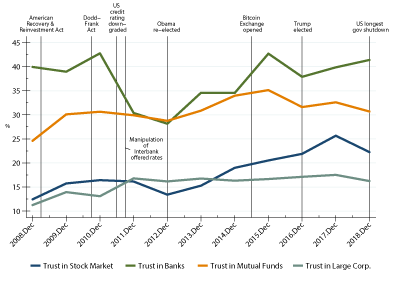

Financial Trust Index

Percentages of people trusting various components that comprise the Financial Trust Index

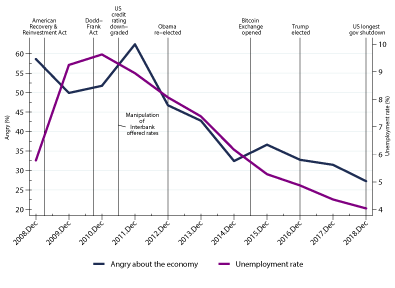

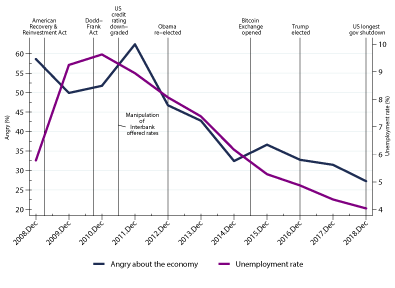

Percentages of people being angry about the current economy

Paola Sapienza and Luigi Zingales1

CHICAGO (February 14, 2019)—Ten years after the financial crash of 2008, Americans’ trust in financial institutions is on the rise, increasing from 22 percent in 2008 to 28 percent in 2018, according to the Financial Trust Index (FTI), administered by the University of Chicago Booth School of Business and Northwestern University’s Kellogg School of Management.

Though the past decade has shown a sharp increase in financial trust, that rise was not a linear path. After an initial recovery between 2008 and 2010, financial trust took another dip in 2011 and 2012.

Three components of the FTI -- trust in the stock market, mutual funds, and large corporations -- reached its lowest point at the end of 2008, which was the peak of the financial crisis. While there were some dips in the FTI, all three components grew steadily over the next ten years. In particular, trust in the stock market rose steadily after the re-election of President Obama until a small drop in 2018.

Even with the bank bailouts of 2008 and 2009, the FTI showed in the end of 2008 that 40 percent of Americans trusted banks, 25 percent trusted mutual funds, 12 percent trusted the stock market, and 11 percent trusted large corporations. Over the following decade, banks have been the most trusted institution each year except 2012, when trust in banks dipped slightly below that of mutual funds. Trust in banks rose after Obama’s re-election and reached 41 percent at the end of 2018.

The most severe dip in this series occurred in 2011, when the Libor and JPMorgan London Whale scandals erupted, undermining the confidence that banks’ problems were under control.

By contrast, trust in large corporations was very low in 2008 (11 percent) and, while seeing an increase to 16 percent today, remains very low.

The percentage of Americans who reported anger about the economy dropped from almost 60 percent in 2008 to 27 percent today. Americans reached their peak in 2011, with 62 percent responding that they were angry about the economy. As the economic growth consolidated, however, and the level of anger also subsided. Trust in media was: the New York Times (37 percent), the Wall Street Journal (36 percent), CNN (34 percent), Fox News (28 percent), and Facebook (8 percent).

In the supplement to the 27th wave survey, respondents also answered questions on their trust in media outlets and various professions, their attitudes toward the North American Free Trade Agreement (NAFTA), and their attitudes toward the tariffs imposed on China.

For professions, trust level was: doctors (65 percent), high school teachers (55 percent), college professors (49 percent), economists (29 percent), journalists (28 percent), lawyers (19 percent), and politicians (5 percent). Regarding attitudes toward free trade: 43 percent of respondents think NAFTA has been good for the United States, and 43 percent of respondents think imposing tariffs on China is bad for the United States.

ABOUT THE SURVEY: On an annual basis, the Financial Trust Index captures the level of trust that Americans have in institutions. The study was conducted for the Financial Trust Index via telephone by SSRS, an independent research company. Interviews were conducted during the period December 18–27, 2018, among financial decision makers. A total of 1,010 interviews were conducted, with a margin of error for total respondents of +/-3.74 percenct at the 95 percent confidence level. More information about SSRS can be obtained by visiting www.ssrs.com.

1 Paola Sapienza is the Donald C. Clark/HSBC Chair in Consumer Finance Professor at the Kellogg School of Management at Northwestern University. Luigi Zingales is the Robert C. McCormack Distinguished Service Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business.

|

|