| About |

| The Results Wave 28 Wave 27 Wave 26 Wave 25 Wave 24 Wave 23 Wave 22 Wave 21 Waves 11-20 Waves 1-10 |

| Working Paper Series |

| Related Research |

| Authors |

| Sponsors |

| FAQ |

| Contact |

| Press Room |

|

Chicago Booth/Kellogg School Financial Trust Index Reveals Public Concern over Income Inequality, Broken Education System

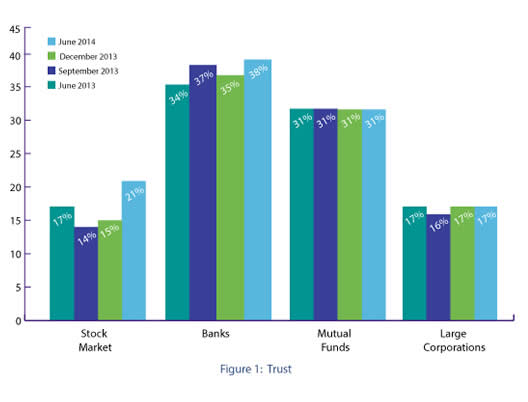

Though the collective measure of financial trust is up, driven mainly by more positive attitudes toward banks and the stock market, Americans are concerned about growing income inequality and would like to see improvements in the country’s educational system as a starting point to address that inequality, according to the latest Chicago Booth/Kellogg School Financial Trust Index.

Co-authors Luigi Zingales, the Robert C. McCormack Professor of Entrepreneurship and Finance and the David G. Booth Faculty Fellow of the University of Chicago Booth School of Business, and Paola Sapienza, the Merrill Lynch Capital Markets Research professor of finance at Kellogg School of Management at Northwestern University, conducted the survey of 1,014 financial decision makers between June 18 and June 25 of this year. Even with improved employment numbers, 44 percent of respondents are worried about income inequality in the Unites States, with the majority (58 percent) blaming the loss of jobs to foreign countries as the core problem. Others point to huge salaries in the financial sector as the main issue; only 38 percent blame inequality on a weakening power of the unions. Additionally, an overwhelming majority— 59 percent— think improving the overall educational system is the first step in battling economic inequality. Only 31 percent prefer a tax on the high income people, and a mere 7 percent believe an inheritance tax as a way to fight inequality.

"While on average, the economy, the housing market, and the stock market are doing better, Americans fear that – because of income inequality – most of them will not enjoy the benefits of these improvements," Sapienza says. |