| About |

| The Results Wave 28 Wave 27 Wave 26 Wave 25 Wave 24 Wave 23 Wave 22 Wave 21 Waves 11-20 Waves 1-10 |

| Working Paper Series |

| Related Research |

| Authors |

| Sponsors |

| FAQ |

| Contact |

| Press Room |

|

The Results: Wave 9

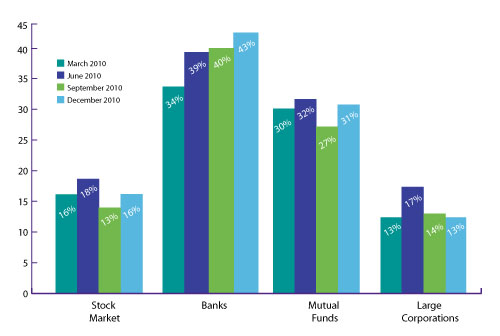

Paola Sapienza and Luigi Zingales1 January 24, 2011 – According to the Chicago Booth/Kellogg School Financial Trust Index issued today, trust in America’s financial system has increased significantly in the past two years. While the first issue of the Index from January 2009 revealed that 20 percent of Americans trusted the financial system in the wake of the economic crisis, two years later trust has reached nearly 26 percent.

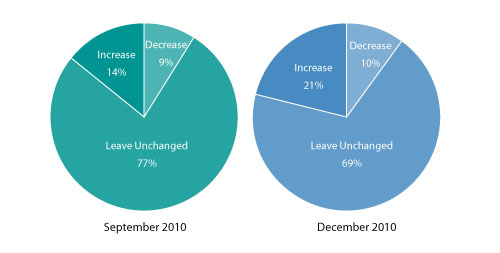

However, while trust and confidence are steadily increasing overall, today’s report also finds lingering discontent toward mortgage lenders. The new data shows that even people morally opposed to strategic default said they would be more likely to default on their mortgage loan if they knew their lender or bank had been accused of predatory lending. The Chicago Booth/Kellogg School Financial Trust Index is a quarterly look at Americans’ trust in the nation’s financial system, measuring public opinion over three-month periods to track changes in attitude. Co-authors Paola Sapienza, professor of finance at the Kellogg School of Management at Northwestern University, and Luigi Zingales, professor of entrepreneurship and finance at the University of Chicago Booth School of Business, published today’s report as the ninth quarterly update. The latest issue looks at the period covering October through December 2010. “The growing trust and optimism toward the financial system is consistent with a sense of economic recovery,” said Sapienza. “According to our latest survey, factors driving this increase include more of a willingness to invest in the stock market and less fear of a drop. Plus, the Index shows that trust in banks has gained the most ground since the first issue of the Index – increasing by nearly 10 percentage points -- demonstrating that the banking industry’s reputation is rebounding.” Growing Confidence in the Stock Market and Banks

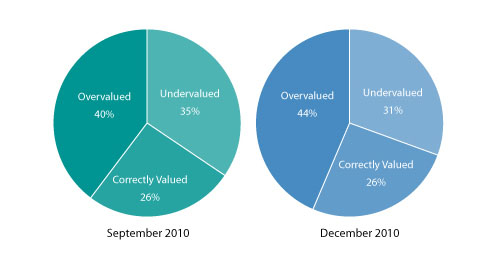

The researchers also found a slight increase in the number of Americans who see the market as being overvalued (from 40 percent in September 2010 to 44 percent now), while fewer now view it as undervalued (35 percent in September 2010 to 31 percent in the most recent quarter). Trust in banks has also gone up from its lowest point of 33 percent two years ago to 43 percent today.

A Look at Strategic Default, Predatory Lending “Interestingly, 48 percent of Americans said they would be more likely to default if their bank was accused of predatory lending, even if they’re morally opposed to strategic default. And, 11 percent said they’d be less likely to pay their mortgage and more likely to walk away from their loan if their bank or lender used false or faulty documentation in trying to foreclose,” said Zingales. “One likely reason for this may be related to a psychological notion of retribution – as if the homeowner is more likely to get back at their bank or lender for being dishonest in the first place.” Optimism for Housing Values, Lack of Confidence in Job Future

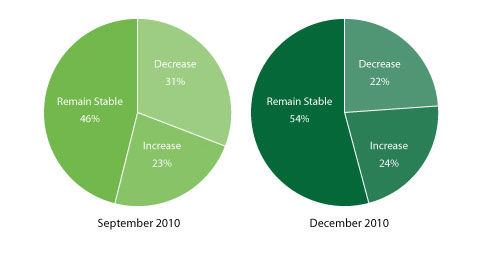

“Lastly, the one area where we’ve continued to see a lack of confidence is in employment and job security,” said Sapienza. “People surveyed reported a 1 in 4 chance that they could lose their job in the next 12 months. This figure has remained constant over the full two years of the Financial Trust Index, which suggests that the growing optimism about the health of the economy has not yet trickled down to attitudes toward the job market.” ABOUT THE SURVEY: On a quarterly basis, the Financial Trust Index captures the amount of trust Americans have in the institutions in which they can invest their money. The survey is conducted by Social Science Research Solutions (SSRS) using ICR's weekly telephone omnibus service. As part of the most recent wave, a total of 1,003 individuals were surveyed December 15 through December 21, 2010. The institutions considered in the survey are banks, the stock market, mutual funds, and large corporations. 1 Paola Sapienza is a Professor of Finance at the Kellogg School of Management at Northwestern University and Luigi Zingales is the Robert McCormack Professor of entrepreneurship and finance at the University of Chicago Booth School of Business. |

|||||||||