| About |

| The Results & Wave 28 Wave 27 Wave 26 Wave 25 Wave 24 Wave 23 Wave 22 Wave 21 Waves 11-20 Waves 1-10 |

| Working Paper Series |

| Related Research |

| Authors |

| Sponsors |

| FAQ |

| Contact |

| Press Room |

|

The Results: Wave 17

Paola Sapienza and Luigi Zingales1 CHICAGO (February 6, 2013) The Chicago Booth/Kellogg School Financial Trust Index finds that more than half of Americans (58 percent) think it likely that the stock market will drop by more than 30 percent in the next 12 months, as compared to 48 percent in the September 2012 report issued before the presidential election. This fear of a large drop is centered primarily among Republicans. “Approximately 67 percent of survey respondents who identified as Republicans think a big drop is likely, versus 50 percent in the last wave. This compares to 44 percent of Democrats,” said Paola Sapienza, co-author of the Financial Trust Index and the Merrill Lynch Capital Markets Research professor of finance at the Kellogg School of Management at Northwestern University. “However, this pessimism did not translate to an intention to decrease investments in the stock market – all told, 76 percent of people surveyed said they will leave their investments unchanged in the next 12 months, and an additional 16 percent plan to increase their investments.”

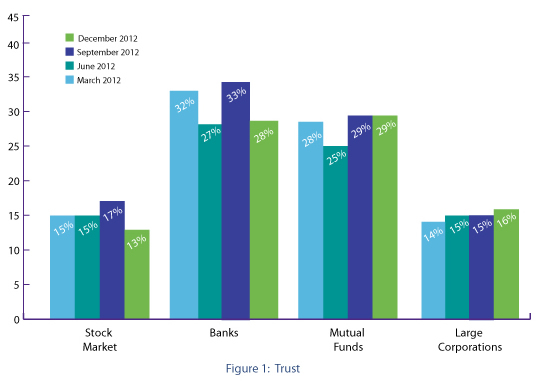

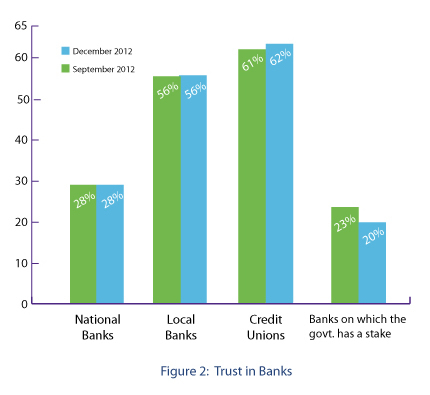

Twenty-two percent of Americans surveyed for the December 2012 report say they trust the country’s financial system – down one percentage point since September 2012 – reflecting a decrease in trust of both the stock market and banks. Sapienza noted that while trust in banks overall is hovering at 28 percent, trust in local banks and credit unions is relatively high at 56 percent and 62 percent respectively.

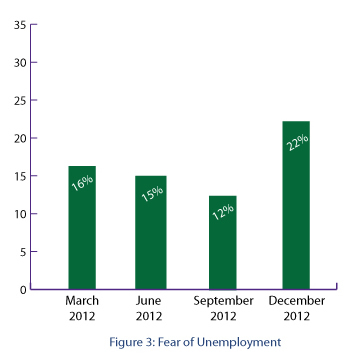

Also, the number of people who believe they are likely to be unemployed within the next year rose a full 10 percent since last quarter, up to 22 percent.

The Chicago Booth/Kellogg School Financial Trust Index measures public opinion over three-month periods to track changes in attitude. This report is the 17th quarterly update and is based on a survey conducted in December 2012. In the paper, “Economic Experts vs. Average Americans,” the researchers take a closer look at several finance and economic policy questions by comparing public opinion from the Index with those of the Chicago Booth IGM Economic Experts Panel, a group of distinguished economists with a keen interest in public policy. “Economists’ opinions differ greatly from those of ordinary Americans,” said Zingales. “In fact, on average the percentage of agreement with a statement differs by 35 percentage points between the two groups. And, when the majority of economists were most in agreement with each other, this is when we saw the greatest disparity from public opinion.” To illustrate the difference in responses between the groups, Zingales pointed to the following:

“This difference of opinion does not seem to be justified by a superior knowledge of economists, but by a different way average Americans interpret the questions. Economists answer them literally and take for granted that all the embedded assumptions are true; average Americans do not,” Sapienza and Zingales concluded in the paper. ABOUT THE SURVEY: On a quarterly basis, the Financial Trust Index captures the amount of trust that Americans have in the institutions in which they can invest their money. The survey is conducted by Social Science Research Solutions (SSRS) as part of their weekly national telephone survey, EXCEL. In the most recent wave, a total of 1,026 individuals were surveyed by live interviewers (not IVR) from Dec. 5 to Dec. 12, 2012. The institutions considered in the survey are banks, the stock market, mutual funds and large corporations. 1 Paola Sapienza is the Merrill Lynch Capital Markets Research Professor of Finance at the Kellogg School of Management at Northwestern University. Luigi Zingales is the Robert R. McCormack Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business. |

|||||||